Financial Rebound in 2025: Credit Risks and Stability Warnings

While 2025 has been a year of recovery, the Central Bank of Sri Lanka (CBSL) has issued a prudent warning regarding underlying credit risks. In its latest Financial Stability Review, the CBSL highlighted that while liquidity has improved, the "quality" of credit remains a concern due to the lag eff...

While 2025 has been a year of recovery, the Central Bank of Sri Lanka (CBSL) has issued a prudent warning regarding underlying credit risks. In its latest Financial Stability Review, the CBSL highlighted that while liquidity has improved, the "quality" of credit remains a concern due to the lag effect of previous economic contractions.

Banks are being advised to maintain strong capital buffers and exercise caution in aggressive lending. "The rebound is real, but we must ensure it is sustainable. We cannot afford a new bubble in consumption credit," the Governor remarked during the report launch.

References:

- Central Bank of Sri Lanka (Publications): https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports

Related Articles

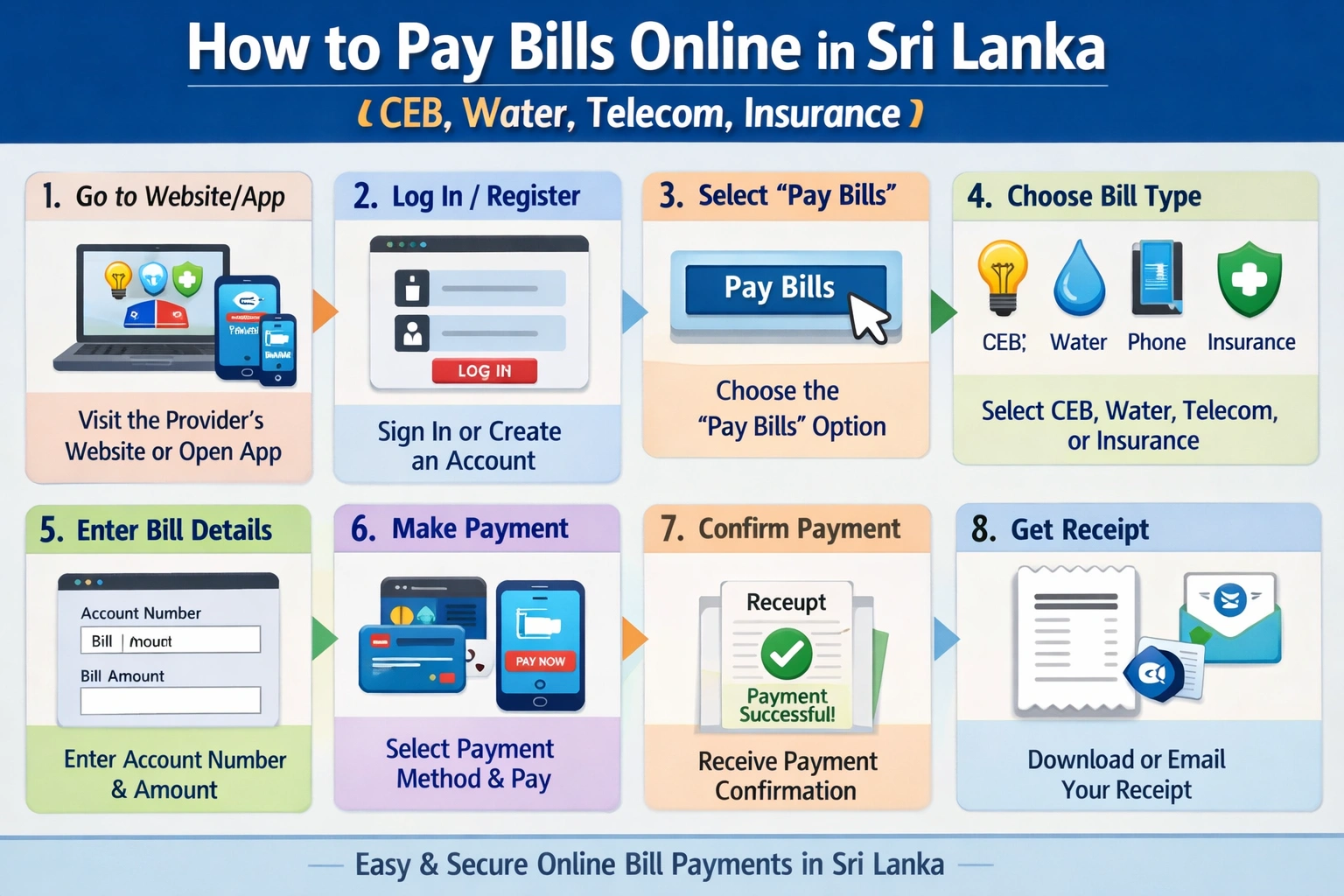

Step‑by‑step guide to paying bills online in Sri Lanka (CEB, water, telecom, insurance)

Why pay your bills online in Sri Lanka? Benefits, safety and what you need first More Sri Lankans now pay everyday bills online, helped by wider internet banking, mobile apps and government platforms such as GovPay operated via LankaPay’s real‑time payment network.[1][2][4][7] What bills can you p...

Remittance guide for Sri Lankans: Best ways to receive money from UAE/Italy/UK/AUS/NZ with low fees.

Why remittances matter for Sri Lankans and what to look for in a transfer For many Sri Lankan families, money sent from the UAE, Italy, the UK, Australia and New Zealand is a lifeline that pays for food, rent, school fees and medical bills. Personal remittances to Sri Lanka are worth over USD 6–7 b...

How to safely use online banking in Sri Lanka: Security checklist for BOC, HNB, Com Bank , Sampath bank users

Online and mobile banking usage in Sri Lanka has surged as people increasingly rely on smartphones and digital channels for everyday transactions, investments and payments.[2] With Bank of Ceylon (BOC), HNB, Commercial Bank and Sampath among the largest retail banks, their broad customer bases and h...

Best mobile payment apps in Sri Lanka 2026: FriMi, mCash, LankaQR and bank apps compared.

Why mobile payment apps matter in Sri Lanka in 2026 Sri Lanka’s digital payments market has grown rapidly on the back of high smartphone use, government-backed cashless initiatives and rising consumer preference for convenient, secure transactions.[1][3] Mobile wallets, QR payments and con...