Contract Work and Freelancing in Canada: The Tax Guide for Sri Lankan Professionals

In Sri Lanka, the job market is relatively binary: you are either a permanent employee with EPF/ETF benefits, or you are doing "business." In Canada, there is a massive middle ground that many skilled immigrants fall into, especially in IT, engineering, and consulting: Contracting. You might see...

In Sri Lanka, the job market is relatively binary: you are either a permanent employee with EPF/ETF benefits, or you are doing "business." In Canada, there is a massive middle ground that many skilled immigrants fall into, especially in IT, engineering, and consulting: Contracting.

You might see a job posting for a Senior Developer. The full-time salary is $110,000. But the contract rate is $90 per hour. You do the quick math ($90 x 2000 hours = $180,000) and think, "Why would anyone take the salary?"

The extra money is real, but it comes with a catch. When you become a contractor, you stop being an employee and start being a business. The government stops taking taxes out of your paycheck, which feels great until April rolls around and you owe the Canada Revenue Agency (CRA) $50,000. Here is the survival guide to the gig economy, tailored for those used to the Sri Lankan system.

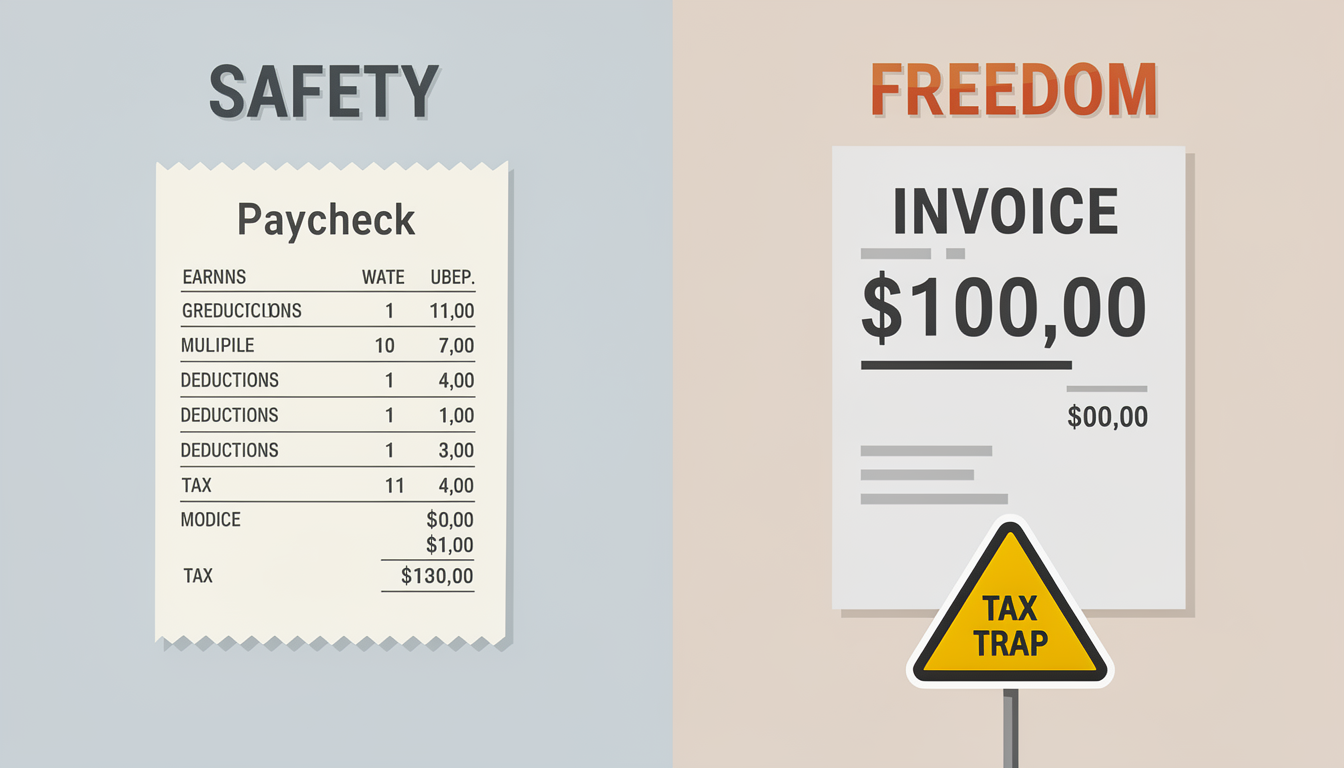

The Fundamental Shift: Employee (T4) vs. Contractor (T4A/Invoice)

First, you need to understand the tax forms, because they dictate your life.

The Employee (T4)

If you are a permanent staff member, your employer handles everything. You get a paycheck with income tax, CPP (pension), and EI (employment insurance) already deducted. At the end of the year, you get a T4 Slip. You file it, and usually, you break even or get a small refund.

The Contractor (Self-Employed)

If you are a contractor, you are a "sole proprietor" or a corporation.

• You invoice the client (e.g., every two weeks).

• They pay you the full amount (plus HST, if applicable).

• Nothing is deducted.

This is where newcomers get in trouble. That $10,000 check isn't yours. About 30-40% of it belongs to the government. If you spend it on a new Honda Civic, you will be in a world of pain at tax time.

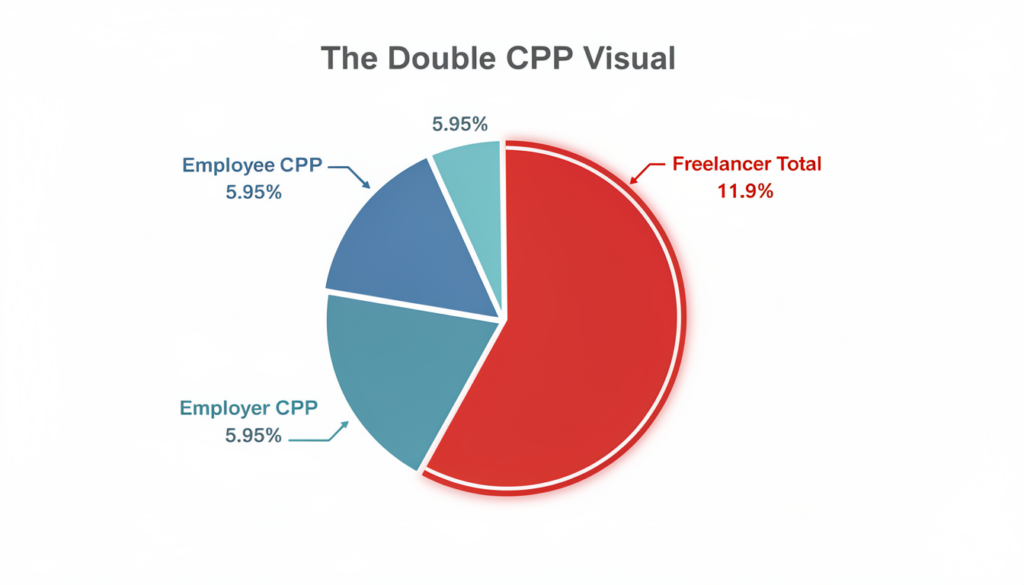

The "Double Tax" Shock: Canada Pension Plan (CPP)

This is the number one complaint I hear from new freelancers.

In Canada, the government pension (CPP) is funded by workers.

• Employees pay roughly 5.95% of their income.

• Employers match that 5.95%.

• Total: 11.9%.

When you are self-employed, you are both the employee and the employer. You must pay both halves.

For 2025, if you earn over $71,300, you will write a check to the CPP for over $8,000. This is mandatory; you cannot opt out. When you calculate your hourly rate, factor this "hidden tax" in.

The Fun Part: Write-Offs (Deductions)

Why do people do it? Because unlike employees, you can deduct business expenses to lower your taxable income.

- Home Office: If you use a spare room exclusively for work, you can deduct a portion of your rent/mortgage interest, electricity, heat, and internet. (Note: "Exclusively" is key. Working from your dining table doesn't count).

- Equipment: That $3,000 MacBook Pro? That’s a business expense.

- Phone: The business percentage of your mobile bill.

- Accounting Fees: The money you pay your accountant to figure this out is deductible.

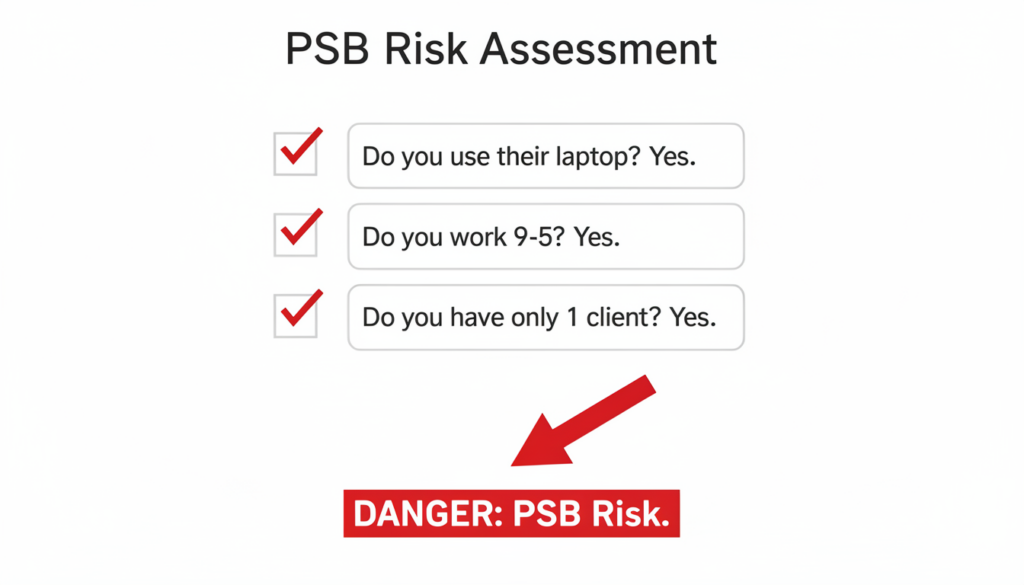

The Dangerous Trap: Personal Services Business (PSB)

Many Sri Lankan IT professionals incorporate a company to take contracts, thinking they can pay a low corporate tax rate (approx. 12%).

Warning: The CRA has a rule called Personal Services Business (PSB).

If you work for one client, use their laptop, work their hours (9-5), and attend their team meetings, the CRA says you are an "Incorporated Employee," not a real business.

If they audit you and decide you are a PSB:

1. You lose the low tax rate (it jumps to ~44% or higher).

2. They deny your expense deductions.

3. You pay penalties.

Expert Advice: If you look like an employee, be an employee. Only incorporate if you have multiple clients or true independence.

Employment Insurance (EI): To Opt-In or Not?

As a freelancer, you generally don't pay into Employment Insurance. This means if your contract ends, you cannot claim unemployment benefits.

The Exception: You can voluntarily pay into "EI Special Benefits" to get access to Maternity/Paternity leave or Sickness benefits.

The Catch: Once you opt in and claim a benefit, you are locked in forever. Most high-earning contractors skip this and self-insure by saving their own emergency fund.

The $30,000 HST Rule (Refresher)

We mentioned this in the business guide, but it bears repeating for freelancers.

Once you bill over $30,000 in any 12-month period, you must register for an HST number and start charging sales tax (e.g., 13% in Ontario) on top of your fee.

Do not forget this. If you bill a client $100 and don't charge HST, the CRA will assume the $100 included the tax, and you will have to pay them $11.50 out of your own pocket.

Conclusion

Contracting offers freedom and a higher ceiling for earnings. It is fantastic for disciplined professionals who can manage their cash flow. But it requires a mindset shift.

In Sri Lanka, you might "settle up" your taxes loosely. In Canada, the CRA is a machine. My advice? Open a separate savings account. Every time a client pays you, immediately transfer 30% of it into that account and pretend it doesn't exist. That money belongs to the Queen (or rather, the King). The rest is yours to enjoy.

References

- Canada Revenue Agency. (2025). Employee or Self-employed? RC4110 Guide.

- TurboTax Canada. (2025). What is a Personal Services Business (PSB)?

- CRA. (2025). Business Expenses for Self-Employed.

- CFIB. (2024). Employment Insurance for Self-Employed People.

- Government of Canada. (2025). CPP Contribution Rates.

Related Articles

Australia - Schedule 3 Issues: Protecting Your Visa Status While Building Relationships

In the world of Australian immigration, "Schedule 3" is a term that strikes fear into the hearts of onshore applicants. For many Sri Lankans who travel to Australia on a student or visitor visa and subsequently fall in love with an Australian citizen or permanent resident, the transition to a Partn...

Common Australia Visa Mistakes for Sri Lankans: Avoiding the Pitfalls in 2026

The journey from Sri Lanka to Australia is paved with good intentions but often derailed by small, avoidable errors. In 2026, the Australian Department of Home Affairs (DoHA) has moved toward a "zero-tolerance" digital verification system. A single inconsistency in your employment dates or a "parke...

Australia Credential Recognition: Getting Your Sri Lankan Qualifications Assessed

One of the biggest hurdles for Sri Lankan professionals moving to Australia is "Credential Recognition." You may be a senior engineer in Colombo or a lead developer in Kandy, but to the Australian Department of Home Affairs, your skills don't exist until they are "validated" by an Australian assess...

Australia Partner Visa: The Path to Permanent Residency for Couples

For many Sri Lankans, the journey to Australia isn't just about a career—it's about reuniting with a loved one. Whether you have married an Australian citizen, are in a long-term de facto relationship, or are planning to wed your fiancé(e), the Australian Partner Visa is the specialized pathway des...