Emergency Finance and Trade: Shielding Sri Lanka's Export Engine

Cyclone Ditwah threatened Sri Lanka's $12 billion export engine—40% apparel, 15% tea/rubber—but swift multilateral emergency finance preserved vital foreign exchange and 2 million jobs. ADB's $40 million trade guarantees enabled 500 exporters to secure working capital despite $200 million cyclone d...

Cyclone Ditwah threatened Sri Lanka's $12 billion export engine—40% apparel, 15% tea/rubber—but swift multilateral emergency finance preserved vital foreign exchange and 2 million jobs. ADB's $40 million trade guarantees enabled 500 exporters to secure working capital despite $200 million cyclone damages to factories/plantations. World Bank repurposed $112 million for port repairs, clearing Colombo backlogs that idled 100 vessels carrying $500 million garments.

Apparel, employing 350,000 (80% women), faced 20% order delays; guarantees restored EU/US shipments, stabilizing wages for coastal workers. Tea estates in Nuwara Eliya lost 30% pluckings; finance bridged to next harvest, protecting 150,000 smallholders earning Rs25,000 monthly. Fisheries exports ($250M) resumed via insured boats for 50,000 Eastern families.

These interventions prevented 2% GDP contraction, injecting 1.2% stimulus via reconstruction. Lessons from 2019 floods inform digital trade platforms cutting clearance to 24 hours, 30% cost savings.

Climate-proofing escalates: crop insurance covers 1M farmers, port elevation protects against 1m sea rise by 2050. Public-private bonds fund resilient infrastructure.

In conclusion, emergency finance safeguards Sri Lanka's export lifeline, but resilient strategies ensure this 12% GDP pillar reliably sustains jobs, rural prosperity, and economic sovereignty against escalating climate threats.

References:

https://www.worldbank.org/en/news/press-release/2025/12/12/the-world-bank-group-statement-on-sri-lanka-following-cyclone-ditwah

https://www.adb.org/news/adb-mobilizes-40-million-emergency-trade-finance-support-sri-lanka-following-cyclone-ditwah

Related Articles

From Stability to Growth: Is Sri Lanka Back on Global Investors' Radar?

International investor sentiment toward Sri Lanka has warmed significantly, with foreign direct investment (FDI) surging 15% to $507 million in January-October 2025, signaling confidence in post-crisis stability and President Dissanayake's reform trajectory. Apparel captured 40% ($200M) via Indian/...

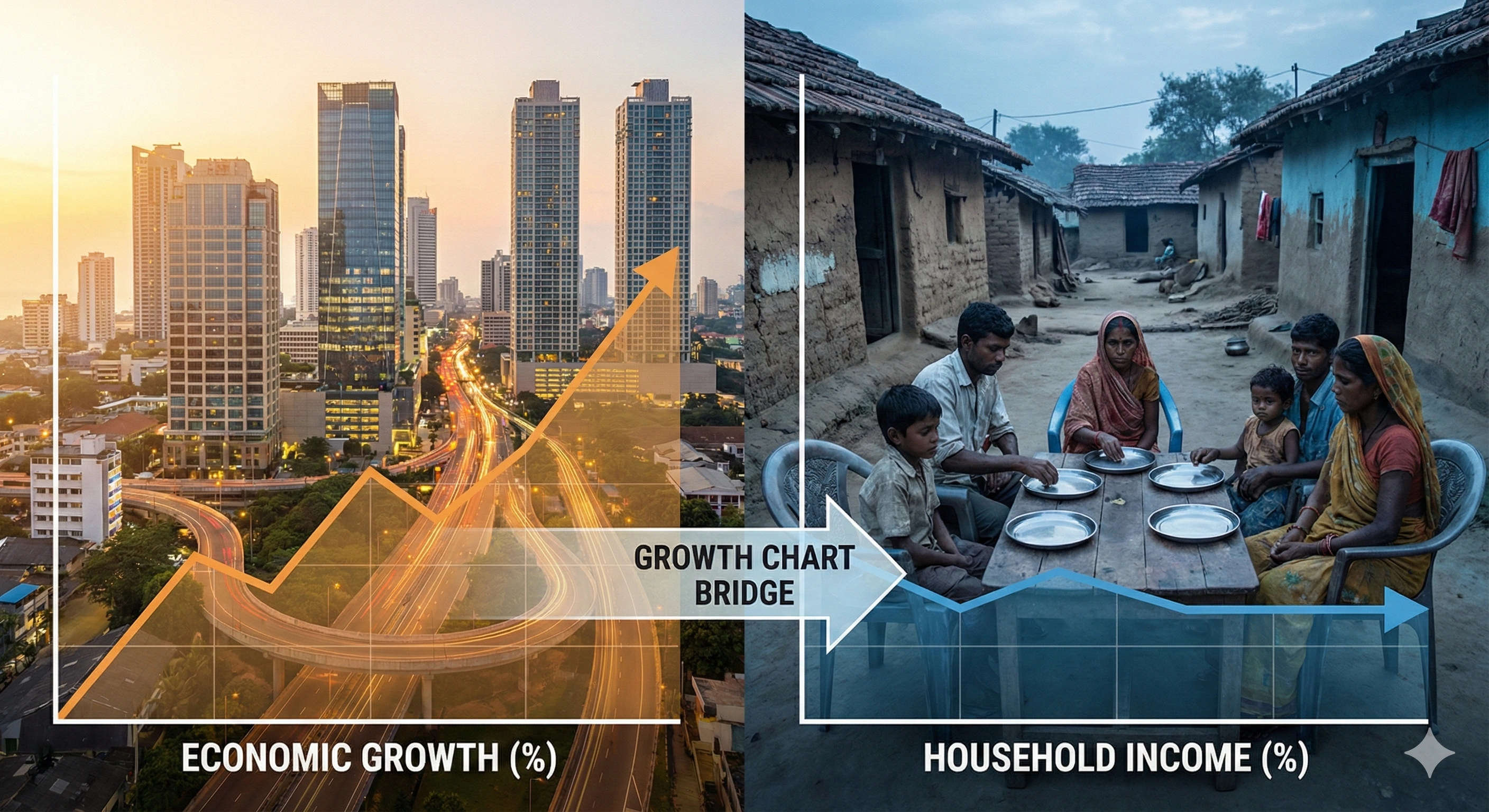

Sri Lanka's Recovery "Still Incomplete": What That Means for Ordinary People

The World Bank characterizes Sri Lanka's post-crisis trajectory as "strong but incomplete," with poverty rates 10% above 2019 levels and 25% of households grappling with food insecurity despite 5.4% Q3 growth. Macro indicators shine—reserves $5.2B, inflation 5.8%, debt stabilizing—but micro-level s...

Cyclone Ditwah's Toll on Tourism and Exports: Recovery Timelines

The tourism and export sectors are facing a challenging Q1 2026 following the devastation of Cyclone Ditwah. While major resort chains in the south remained largely intact, coastal SMEs and agricultural exports suffered significant disruptions. The Sri Lanka Tourism Development Authority (SLTDA) ha...

Economic Resilience Amid Geopolitical Shifts: Double FDI Inflows Analyzed

Sri Lanka has recorded a remarkable doubling of Foreign Direct Investment (FDI) inflows in 2025, a surge attributed to the island's strategic positioning amid shifting global power dynamics. With major trade routes becoming increasingly contested, investors from both the East and West are viewing S...