From Stability to Growth: Is Sri Lanka Back on Global Investors' Radar?

International investor sentiment toward Sri Lanka has warmed significantly, with foreign direct investment (FDI) surging 15% to $507 million in January-October 2025, signaling confidence in post-crisis stability and President Dissanayake's reform trajectory. Apparel captured 40% ($200M) via Indian/...

International investor sentiment toward Sri Lanka has warmed significantly, with foreign direct investment (FDI) surging 15% to $507 million in January-October 2025, signaling confidence in post-crisis stability and President Dissanayake's reform trajectory. Apparel captured 40% ($200M) via Indian/Singaporean factory expansions in Katunayake SEZ, tourism drew $127M for 20 new southern resorts, and IT/BPO secured $100M targeting European digital compliance contracts. Board of Investment approvals for 300+ projects promise 30,000 jobs, technology transfer in automation, and $1 billion annual export uplift.

Strategic versus portfolio inflows distinguish this wave: 70% long-term greenfield investments versus speculative bonds, reducing volatility risks seen in 2021 taper tantrums. Neighboring Bangladesh/India comparisons favor Sri Lanka's English proficiency (20% population fluent), geopolitical neutrality amid US-China tensions, and 15% corporate tax holidays through 2028. Hambantota SEZ revival attracts Japanese logistics firms, creating 10,000 positions with local sourcing mandates ensuring 60% Sri Lankan employment.

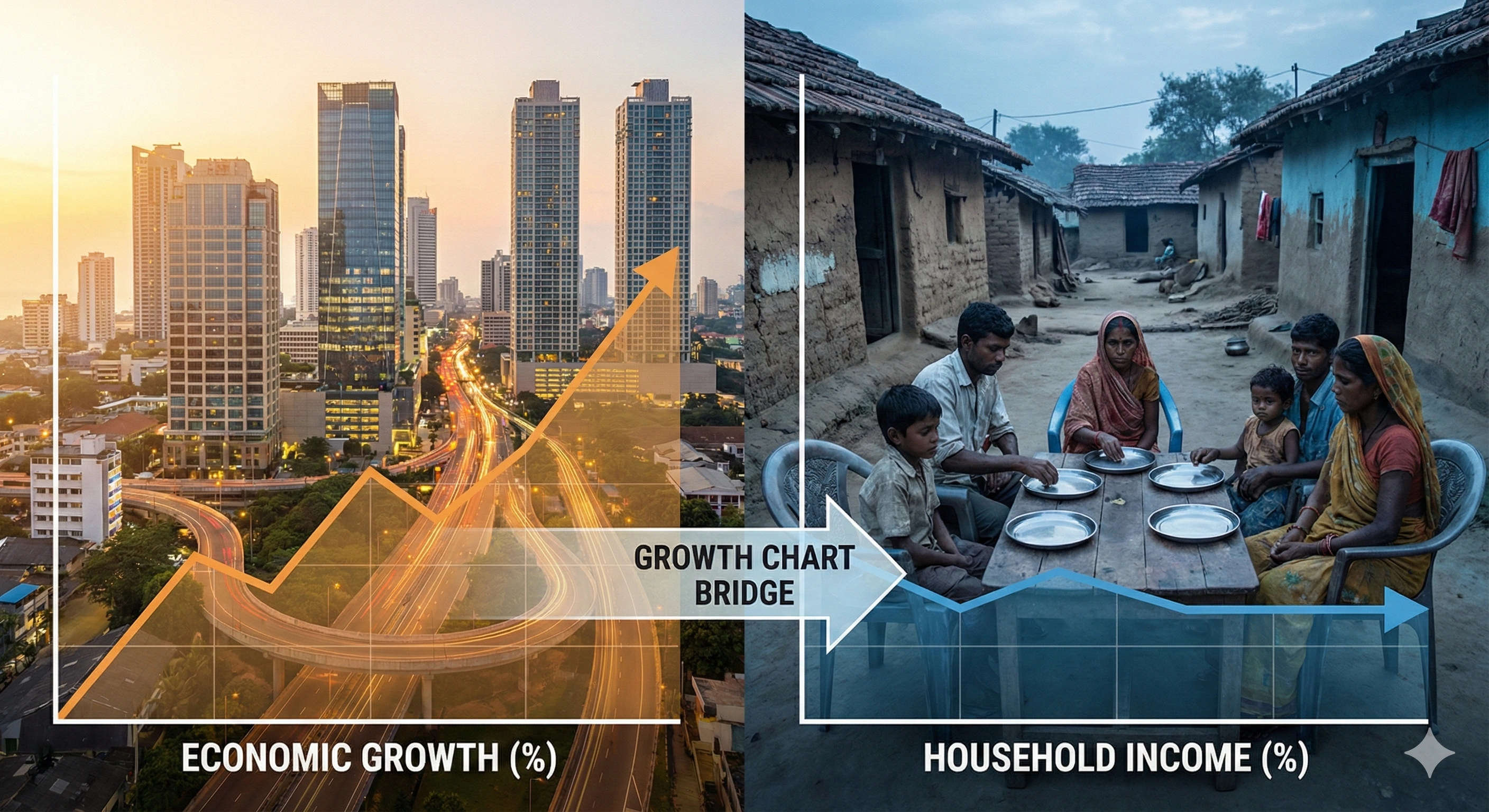

For communities, benefits materialize through multiplier effects: each FDI dollar generates 2.5 jobs via supply chains benefiting 50,000 MSMEs. Women's participation rises to 35% in new factories with creche facilities. However, risks loom—policy reversals on tax breaks, 23% youth unemployment mismatches, and cyclone disruptions underscore insurance gaps.

Equitable frameworks demand: 30% local content rules preventing enclave economies, TVET upgrades training 100,000 for Industry 4.0, and profit repatriation caps channeling 10% to community funds. Capital Markets Authority's ESG bond issuances ($200M target) align green FDI with climate resilience.

Past cycles warn caution: 2010-2015 FDI boom bypassed North/East; transparent BOI portals now track regional distribution. Regional peers like Vietnam leverage FDI for 7% growth through skill ecosystems Sri Lanka must emulate.

In conclusion, Sri Lanka's investor renaissance offers catalytic growth if harnessed equitably—jobs for youth, tech for competitiveness, revenues for welfare—transforming stability into inclusive prosperity without repeating boom-bust traps that marginalized communities.

References:

https://internationalbanker.com/finance/sri-lanka-from-stability-to-growth/

https://www.reuters.com/world/asia-pacific/sri-lankan-economy-grew-54-third-quarter-2025-2025-12-15/

https://www.cbsl.gov.lk/en/sri-lanka-economy-snapshot

Related Articles

Emergency Finance and Trade: Shielding Sri Lanka's Export Engine

Cyclone Ditwah threatened Sri Lanka's $12 billion export engine—40% apparel, 15% tea/rubber—but swift multilateral emergency finance preserved vital foreign exchange and 2 million jobs. ADB's $40 million trade guarantees enabled 500 exporters to secure working capital despite $200 million cyclone d...

Sri Lanka's Recovery "Still Incomplete": What That Means for Ordinary People

The World Bank characterizes Sri Lanka's post-crisis trajectory as "strong but incomplete," with poverty rates 10% above 2019 levels and 25% of households grappling with food insecurity despite 5.4% Q3 growth. Macro indicators shine—reserves $5.2B, inflation 5.8%, debt stabilizing—but micro-level s...

Cyclone Ditwah's Toll on Tourism and Exports: Recovery Timelines

The tourism and export sectors are facing a challenging Q1 2026 following the devastation of Cyclone Ditwah. While major resort chains in the south remained largely intact, coastal SMEs and agricultural exports suffered significant disruptions. The Sri Lanka Tourism Development Authority (SLTDA) ha...

Economic Resilience Amid Geopolitical Shifts: Double FDI Inflows Analyzed

Sri Lanka has recorded a remarkable doubling of Foreign Direct Investment (FDI) inflows in 2025, a surge attributed to the island's strategic positioning amid shifting global power dynamics. With major trade routes becoming increasingly contested, investors from both the East and West are viewing S...