Remote Work and Health Insurance

As a remote worker, you're likely no stranger to the benefits of flexibility and autonomy that come with working from anywhere. However, one aspect of remote work that can be tricky to navigate is health insurance. You may be wondering how to find affordable and comprehensive coverage that meets yo...

As a remote worker, you're likely no stranger to the benefits of flexibility and autonomy that come with working from anywhere. However, one aspect of remote work that can be tricky to navigate is health insurance. You may be wondering how to find affordable and comprehensive coverage that meets your needs. In this article, you'll learn about the different health insurance options available to remote workers, how to choose the right plan, and what to consider when it comes to tax implications.

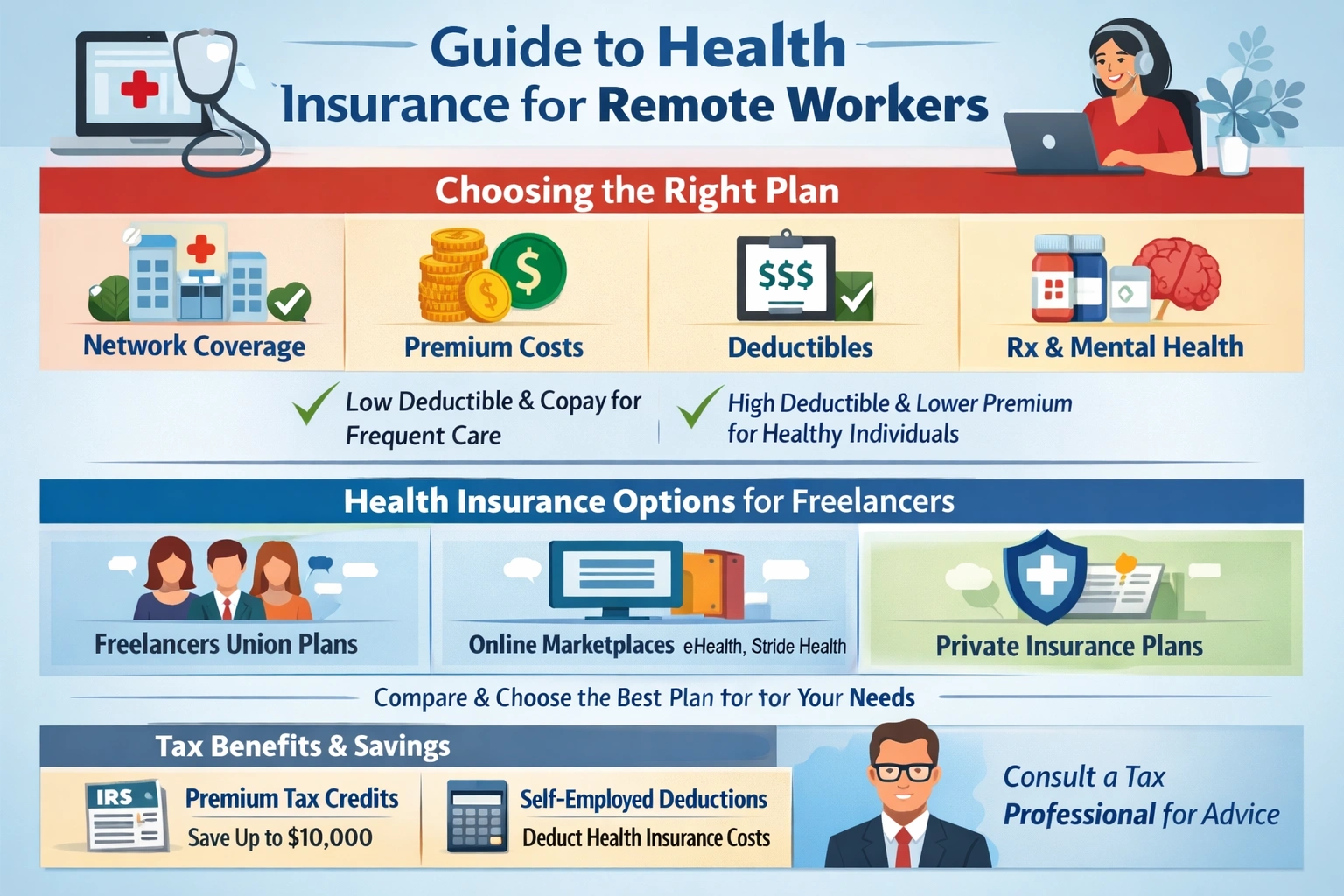

By the end of this article, you'll have a clear understanding of the health insurance landscape for remote workers and be equipped with the knowledge to make informed decisions about your own coverage. You'll learn about the various types of health insurance plans, including individual and group plans, and how to evaluate factors such as network coverage, premium costs, and deductibles. Whether you're a freelancer, independent contractor, or full-time remote employee, this article will provide you with the insights and guidance you need to secure the right health insurance for your needs.

Introduction to Remote Work and Health Insurance

Remote work has become increasingly popular in recent years, with over 4.7 million employees in the United States working remotely at least half of the time. This shift towards remote work has created new challenges and opportunities for workers, including the need to navigate health insurance options. According to a survey by Gallup, 43% of employed adults in the United States are working remotely at least some of the time, which has led to an increase in demand for health insurance plans that cater to remote workers.

When it comes to health insurance, remote workers have several options to choose from, including individual plans, group plans, and short-term plans. Individual plans are designed for individuals and families who are not eligible for group coverage, while group plans are typically offered through an employer or professional organization. Short-term plans, on the other hand, provide temporary coverage for a limited period, usually up to 12 months. Understanding the different types of health insurance plans and their benefits is essential for remote workers to make informed decisions about their coverage.

For example, Upwork, a popular freelance platform, offers a range of health insurance plans to its members, including individual and group plans. Similarly, Remote.co, a platform that connects remote workers with job opportunities, provides resources and guidance on health insurance options for remote workers. These examples illustrate the growing recognition of the need for health insurance solutions that cater to the unique needs of remote workers.

Types of Health Insurance for Remote Workers

Remote workers have several types of health insurance plans to choose from, each with its own benefits and drawbacks. Individual plans are a popular option for remote workers who are not eligible for group coverage. These plans can be purchased through the Affordable Care Act (ACA) marketplace or directly from an insurance provider. Group plans, on the other hand, are typically offered through an employer or professional organization and can provide more comprehensive coverage at a lower cost.

Short-term plans are another option for remote workers who need temporary coverage. These plans provide limited coverage for a short period, usually up to 12 months, and are often less expensive than individual or group plans. However, short-term plans may not provide the same level of coverage as other plans and may not be renewable. Association health plans (AHPs) are another option for remote workers, which allow small businesses and self-employed individuals to band together to purchase health insurance.

For instance, the National Association for the Self-Employed (NASE) offers a range of health insurance plans to its members, including individual and group plans. Similarly, the Freelancers Union provides health insurance options to its members, including a range of individual and group plans. These examples illustrate the growing number of health insurance options available to remote workers and the importance of carefully evaluating each option to determine the best fit.

When evaluating health insurance plans, remote workers should consider factors such as network coverage, premium costs, and deductibles. Network coverage refers to the range of healthcare providers and facilities that are covered under the plan, while premium costs refer to the monthly or annual cost of the plan. Deductibles, on the other hand, refer to the amount that must be paid out-of-pocket before the insurance plan kicks in.

How to Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be a daunting task, especially for remote workers who may not have access to traditional employer-sponsored coverage. To make an informed decision, remote workers should consider several factors, including network coverage, premium costs, and deductibles. Network coverage is critical, as it determines which healthcare providers and facilities are covered under the plan.

Premium costs, on the other hand, refer to the monthly or annual cost of the plan, and can vary significantly depending on the type of plan and the level of coverage. Deductibles, which refer to the amount that must be paid out-of-pocket before the insurance plan kicks in, can also have a significant impact on the overall cost of the plan. Remote workers should also consider copays and coinsurance, which refer to the amount that must be paid for specific healthcare services.

For example, a remote worker who requires regular medical care may want to choose a plan with a lower deductible and copay, while a healthy individual who rarely requires medical care may prefer a plan with a higher deductible and lower premium costs. By carefully evaluating these factors and considering their individual needs, remote workers can choose a health insurance plan that provides the right level of coverage at an affordable cost.

Additionally, remote workers should also consider prescription coverage and mental health benefits when choosing a health insurance plan. Prescription coverage refers to the extent to which the plan covers prescription medications, while mental health benefits refer to the level of coverage for mental health services, such as therapy and counseling. By considering these factors, remote workers can ensure that they have access to the healthcare services they need to maintain their physical and mental health.

Remote Work Health Insurance Options for Freelancers

Freelancers, who are often considered independent contractors, may not have access to traditional employer-sponsored health insurance. However, there are several health insurance options available to freelancers, including professional associations, online marketplaces, and private plans. Professional associations, such as the Freelancers Union, offer health insurance plans to their members, which can provide more comprehensive coverage at a lower cost.

Online marketplaces, such as eHealth and Stride Health, allow freelancers to compare and purchase health insurance plans from a range of providers. These marketplaces often provide tools and resources to help freelancers evaluate their options and choose the best plan for their needs. Private plans, on the other hand, can be purchased directly from an insurance provider and may offer more flexibility and customization than other options.

For instance, Freelancers Union offers a range of health insurance plans to its members, including individual and group plans. These plans provide comprehensive coverage, including prescription coverage and mental health benefits, and are often more affordable than private plans. Similarly, eHealth allows freelancers to compare and purchase health insurance plans from a range of providers, making it easier to find the best plan for their needs.

When evaluating health insurance options as a freelancer, it's essential to consider factors such as network coverage, premium costs, and deductibles. Freelancers should also consider their individual needs, such as prescription coverage and mental health benefits, to ensure that they choose a plan that provides the right level of coverage. By carefully evaluating these factors and considering their options, freelancers can find a health insurance plan that meets their needs and fits their budget.

Tax Implications of Remote Work Health Insurance

Remote workers who purchase their own health insurance may be eligible for tax deductions and premium tax credits. The Affordable Care Act (ACA) provides tax credits to individuals and families who purchase health insurance through the marketplace and meet certain income requirements. Remote workers who are self-employed may also be able to deduct their health insurance premiums as a business expense on their tax return.

To qualify for these tax deductions and credits, remote workers must meet certain requirements, such as income limits and eligibility criteria. For example, the ACA provides tax credits to individuals and families with incomes between 100% and 400% of the federal poverty level. Remote workers who are self-employed must also meet certain requirements, such as business income and expense requirements, to qualify for business expense deductions.

For instance, a remote worker who purchases a health insurance plan through the marketplace and meets the income requirements may be eligible for a tax credit of up to $10,000 per year. Similarly, a self-employed remote worker who deducts their health insurance premiums as a business expense may be able to reduce their taxable income by $5,000 per year. By understanding the tax implications of remote work health insurance, remote workers can make informed decisions about their coverage and maximize their tax savings.

Remote workers should consult with a tax professional to ensure that they are taking advantage of all the tax deductions and credits available to them. A tax professional can help remote workers navigate the complex tax laws and regulations surrounding health insurance and provide guidance on how to maximize their tax savings. By seeking professional advice, remote workers can ensure that they are making the most of their health insurance benefits and minimizing their tax liability.

Conclusion and Next Steps for Remote Workers

In conclusion, remote workers have several health insurance options available to them, including individual plans, group plans, and short-term plans. When choosing a health insurance plan, remote workers should consider factors such as network coverage, premium costs, and deductibles. Freelancers, in particular, may want to consider professional associations, online marketplaces, and private plans to find the best coverage for their needs.

Remote workers can also take advantage of tax deductions and credits, such as the Affordable Care Act (ACA) tax credits, to reduce their healthcare costs. By understanding the tax implications of remote work health insurance, remote workers can make informed decisions about their coverage and maximize their tax savings. To get started, remote workers can visit the HealthCare.gov website to explore their health insurance options and find a plan that meets their needs.

Additionally, remote workers can join remote work communities and professional associations to connect with other remote workers and access resources and guidance on health insurance and other benefits. For example, the Remote.co community provides a range of resources and tools for remote workers, including health insurance guides and tax advice. By taking advantage of these resources and seeking professional advice, remote workers can ensure that they have access to the healthcare services they need to maintain their physical and mental health.

Ultimately, finding the right health insurance plan as a remote worker requires careful consideration and planning. By understanding the different types of health insurance plans, evaluating factors such as network coverage and premium costs, and taking advantage of tax deductions and credits, remote workers can make informed decisions about their coverage and ensure that they have access to the healthcare services they need.

Key Takeaways

In summary, remote workers have several health insurance options available to them, and by carefully evaluating these options and considering their individual needs, they can find a plan that provides the right level of coverage at an affordable cost. Remote workers should also be aware of the tax implications of their health insurance choices and take advantage of tax deductions and credits to minimize their healthcare costs.

As you consider your health insurance options, remember to evaluate factors such as network coverage, premium costs, and deductibles, and don't hesitate to seek professional advice if you need guidance. What steps will you take today to ensure that you have access to the healthcare services you need as a remote worker?

Frequently Asked Questions

What are the different types of health insurance available for remote workers?

Remote workers can choose from individual plans, group plans, and short-term plans

How do I choose the right health insurance plan for my needs?

Consider factors such as network coverage, premium costs, and deductibles when selecting a health insurance plan

Related Articles

Home Office Layout Ideas

Are you tired of feeling unproductive and distracted while working from home? You're not alone. Many people struggle to create a dedicated workspace that fosters focus and efficiency. A well-designed home office can be a powerful tool to boost your productivity and overall job satisfaction. By opti...

Best Productivity Tools for Remote Teams 2026

As you sit at your desk, sipping your morning coffee and staring at your computer screen, you can't help but think about the challenges of managing a remote team. You've got team members scattered across different time zones, and it can be tough to keep everyone on the same page. But what if you h...

AI Productivity Tools for Remote Workers

As a remote worker, you're likely no stranger to the challenges of staying productive while working from home. With the constant distractions of family members, household chores, and personal errands, it's easy to get sidetracked and lose focus. But what if you could use artificial intelligence (A...

Remote Work Apps and Software Comparison

As you consider transitioning to remote work, you're likely thinking about how to stay productive, manage your team, and maintain security outside of a traditional office setting. With so many remote work apps and software options available, it can be overwhelming to decide which ones to use. You...